Talroo's Frontline Worker Index

Frontline Worker Index

June 2024 Summary: Mixed Trends in Wage and Employment Indices

Cooling Wages & Bonus Incentives for Frontline Workers: Despite a 9% increase in wages compared to last year, June 2024 saw a slight decline in month-over-month wage rates, breaking the upward trend observed in recent years. Additionally, there has been a notable 10% decrease in sign-on bonuses year-over-year, which could reflect shifts in employer incentives and recruitment strategies.

Resume and Posting Indices: The resume index has dipped by 45 points MoM, indicating a possible decrease in job seeker activity or confidence. Conversely, the posting index has increased by 40 points MoM, suggesting employers are actively seeking more candidates despite the decrease in resumes.

The Frontline Worker Index Data & Findings

The Frontline Worker Index (FWI) offers data insights on supply and demand, job titles, wages, work schedules, education and experience requirements, and the most valued benefits for frontline roles. Understanding these metrics helps HR professionals and recruiters create better strategies for attracting, hiring, and retaining top talent in a competitive job market.

Please note that the data shown in these graphs update regularly, so while this report was created with June 2024 data, the numbers shown in the interactive graphs may be different. However, you can still explore the data from that time period by updating the date range where applicable.

Supply & Demand

The FWI compares new resumes and new job posts to show the balance between job seeker supply and employer demand.

In April, with our last FWI report, there was a noted rise in resumes in the index and fewer postings. However, the exact opposite is true for June 2024. What does this mean for the labor market?

- There is a shortage of qualified candidates, resulting in fewer resumes despite more job openings.

- Fewer individuals are seeking new jobs due to what is being called the “Big Stay”.

- Job seekers are more selective, influenced by better job conditions, remote work preferences, or a desire for higher wages and benefits.

Overall Implications:

- Companies might need to increase their efforts to attract talent, possibly by offering higher wages, better benefits, or more flexible working conditions.

- The labor market could be tilting in favor of job seekers, giving them more bargaining power.

- Employers may need to revisit their recruitment strategies, focusing on improving job postings, offering sign-on bonuses, or enhancing their employment value propositions.

These contrasting trends highlight the dynamic nature of the labor market and underscore the need for both employers and job seekers to stay adaptable and responsive to changing conditions.

Despite this being the general trend, there are some industries that are resilient, according to Talroo data. Retail, Administrative/clerical, Sales, and Warehousing/Logistics don’t seem to be seeing the same indexing, and thus are less likely to be impacted by a resume shortage.

Job Titles

Continuing the discussion on supply and demand from the graph above, this section shows the demand from frontline job seekers using Talroo-associated job boards and search engines, and the supply, which consists of job posts from employers advertising through Talroo.

Supply: Job Seeker Activity

Demand: Employer Job Posts

Half of the top job searches on Talroo-associated job boards and search engines relate more to how frontline and essential workers want to work than what they want to do. This falls in line with what we saw in April, although the percentage has dropped slightly. And much like April’s findings, there’s a correlation between the top searches and the top job titles: the majority include information that pertains to not just what the job will be, but how the work will be.

And despite the fact that Work from Home remains the top query in Talroo-associated job boards and search engines, that index has continued to drop, showing it is less of a priority for employers, which will be discussed more in the Schedules, Hours, & Remote Work section.

Companies that clearly outline what frontline and essential workers want in job descriptions are more likely to attract qualified candidates who fit well with their workplace culture and values.

Wages & Pay

This dataset shows the average wage and sign-on bonus for all jobs listed on the Talroo Ad Platform. Because of salary transparency laws in various states, some states are more represented in the map and final numbers than others.

For example, states like California and New York, which have strict salary transparency requirements, provide more data points, potentially raising the overall averages. On the other hand, states with less strict or no transparency laws may have fewer listings, resulting in less representation in the dataset.

Additionally, only jobs with a starting bonus listed are included in the sign-on bonus index. You can see the percentage of jobs that offer a bonus in Talroo’s ecosystem in the “Offers Bonus” section.

HR professionals and recruiters can use this dataset to improve their hiring strategies. Here are three actions they can take:

- Compare average wages, the percentage of jobs offering sign-on bonuses, and the average bonus value in their industry and region to ensure their offers are competitive.

- Analyze the data to spot emerging compensation trends and adjust salary structures accordingly to stay competitive in the job market.

- Enhance salary transparency in job listings to attract more candidates, as job seekers increasingly value this openness.

Schedules, Hours, & Remote Work

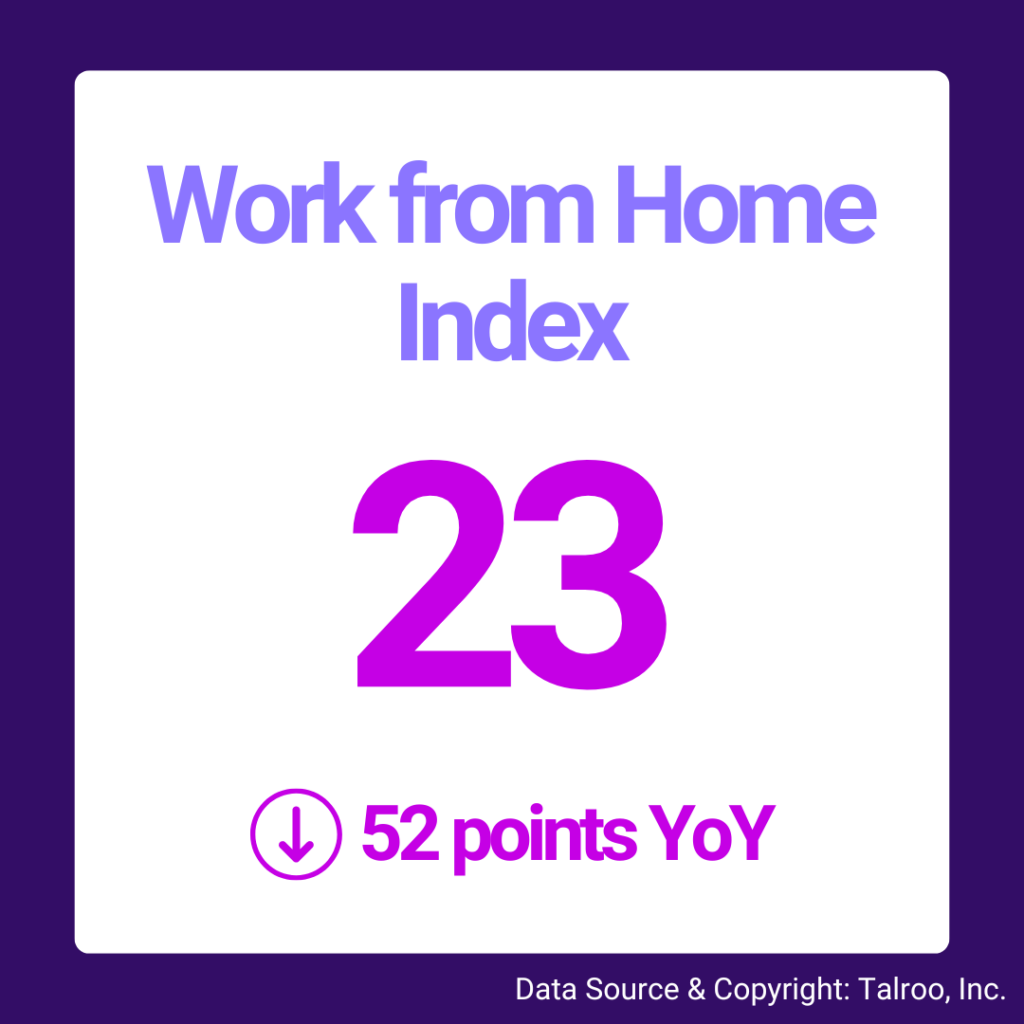

This dataset shows the indexed Work from Home, Part-Time, and Full-Time positions listed by clients on the Talroo Ad Platform. It’s important to note that some positions may be listed as part-time or full-time based on availability or store needs, but this doesn’t necessarily affect the overall numbers.

Key Talroo Data

The trends in the Remote Work or Work from Home index match the “Return to the Office” movement.

- Work from Home positions have dropped 52 points year over year and 12 points month over month for frontline and essential workers.

- This shift shows a growing focus on in-person roles as businesses emphasize on-site operations and face-to-face interactions.

HR professionals and recruiters need to know the Work from Home Index, Part-Time Index, and Full-Time Index for their industry, the positions they’re hiring for, and their state. Here are three key reasons why:

- Anticipate workforce needs and plan accordingly using these indices.

- Adjust job postings and recruitment strategies to align with current market trends.

- Ensure competitive compensation and benefits packages by comparing with industry standards.

Education & Experience

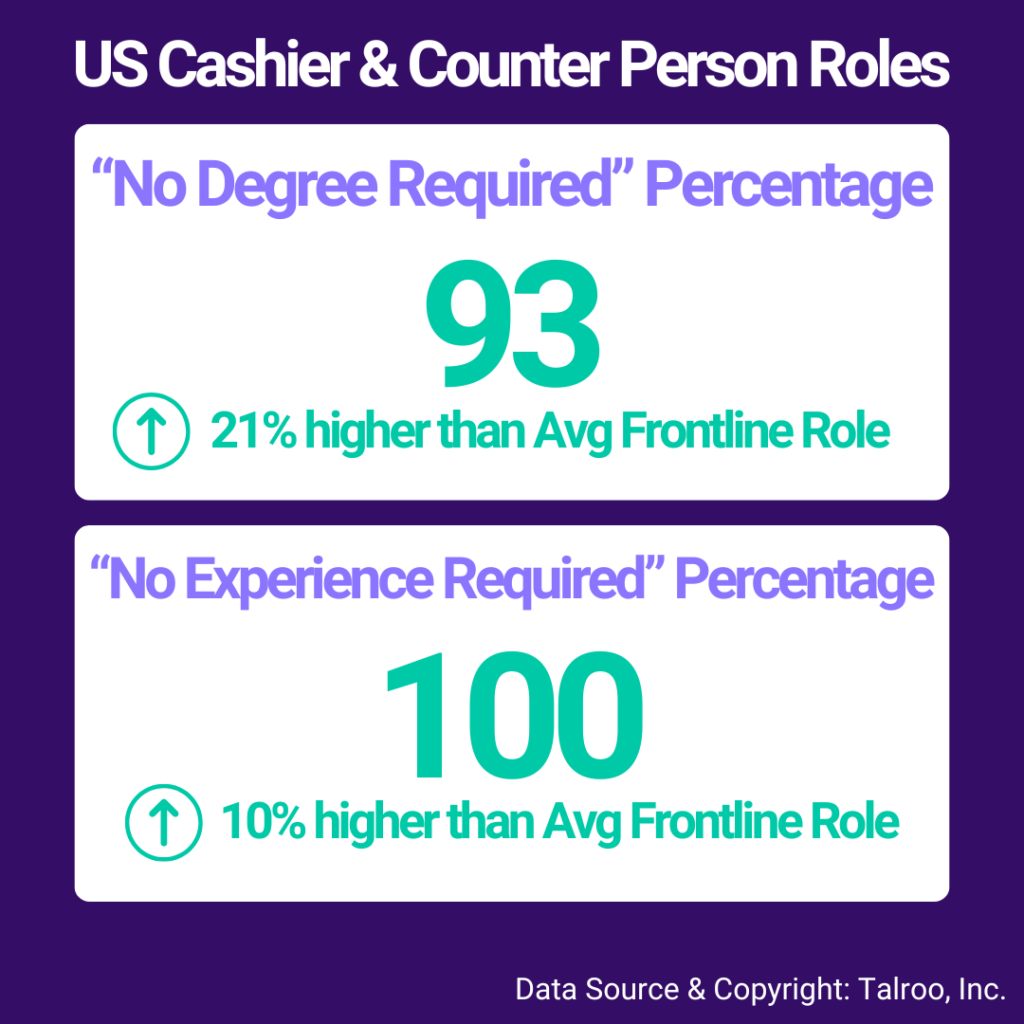

This index includes Talroo clients who list jobs that don’t require education or experience. For example, a cashier position that doesn’t need a high school diploma or prior experience would be part of this index.

Key Talroo Data

Talroo data shows that education and experience requirements have been slowly declining since January 2022, with each index decreasing by 7 and 2 points, respectively. However, the Cashier/Counter Person role provides a clearer picture of the frontline and essential worker landscape.

Let’s look at the data:

- "No Degree Required" is at 93%, which is 21% higher than the national average.

- "No Experience Required" is at 100%, which is 10% higher than the national average.

Both indexes have remained mostly unchanged since January 2022, with “No Degree Required” increasing by two points and “No Experience Required” staying the same.

This trend could be due to several reasons:

- High turnover in frontline and essential roles prompts employers to lower entry barriers to fill positions quickly.

- The ongoing demand for essential services requires rapid hiring, so employers prioritize availability over formal qualifications.

- Companies may offer on-the-job training and upskilling programs, reducing the need for prior education or experience.

Dive into the data with the graphs below to see what requirements look like in specific states or industries:

HR professionals and recruiters can stay competitive with these strategies:

- Lower education and experience requirements to attract a larger pool of candidates and fill positions quickly.

- Invest in on-the-job training and upskilling programs to ensure new hires can quickly adapt and succeed in their roles.

- Emphasize the lack of required experience or education in job postings to appeal to a wider range of applicants.

Benefits

Frontline and essential workers are vital to many industries, ensuring businesses and services operate smoothly. Understanding their key benefits is crucial for effective recruitment and retention.

Important benefits for frontline workers include competitive wages, comprehensive health insurance, paid time off, flexible work arrangements, and professional development opportunities. These benefits provide fair compensation, security, work-life balance, job satisfaction, and career growth.

HR professionals and recruiters can use this knowledge to enhance their hiring and retention strategies. Here are three key actions they can take:

- Offer competitive wages and health benefits to attract and keep top talent.

- Implement flexible work arrangements to boost job satisfaction and reduce stress.

- Provide training and career advancement opportunities to support employee growth.

By focusing on these areas, HR professionals and recruiters can create a more attractive work environment for frontline and essential workers, leading to higher job satisfaction and better retention rates.

Frontline Worker Trends: Economic Trends Impacting the Labor Market

Let’s explore recent trends in the frontline worker labor market, highlighting the impact of economic changes on wage growth, job postings, and sector-specific dynamics. Using Talroo’s data and insights from various economic reports, we provide a comprehensive overview of how these trends are shaping the current and future landscape for frontline workers.

Recent Wage Trends for Frontline Workers

Since December 2023, frontline worker wages have shown a steady increase, reflecting robust demand for these roles. However, recent data from Talroo indicates a slight cooling in wage growth from May to June 2024. This shift suggests potential stabilization or broader economic influences impacting wage dynamics.

- 9% YoY Wage Increase: Frontline worker wages saw a 9% year-over-year increase in June 2024, highlighting significant growth compared to the previous year.

- 3.86% Average Hourly Earnings: U.S. average hourly earnings stood at 3.86% in June 2024, down from 4.05% in May 2024, indicating a cooling trend in wage growth.

- Persistent Inflation: Inflation remains a key factor, with CPI inflation projected to persist above 3% until mid-2025.

- Resilient Sectors: Retail, administrative support, sales, and logistics/warehousing sectors show more resilience in maintaining wage growth despite broader economic trends.

The trends observed in frontline worker wages and economic conditions underscore the complex interplay between market demand, economic policies, and sector-specific dynamics. As the labor market stabilizes and adapts to broader economic shifts, monitoring these trends will be crucial for employers and workers alike to navigate the evolving landscape.

External Sources: Bureau of Labor & Statistics, Deloitte, & JP Morgan

Key Data

Frontline Worker Index Explorer

To explore Talroo’s data and search findings for recruiting and hiring, use the Industry Explorer below. You can view nationwide trends or focus on specific states. Additionally, you can narrow your search by selecting industries or specific job titles. Happy searching!

The Frontline Worker Index Report: Methodology

Talroo processes an average of 26 million job posts every month, with over 187 million data points adding to this index directly. This extensive dataset is sourced first-party directly from Talroo, reflecting a broad spectrum of industries and geographic locations. Some job posts are comprehensive while others are less detailed; our goal is to encourage companies to be more transparent and intentional with their job posts to improve data quality and utility.

The FWI reflects information from a wide range of sectors, powered by Talroo’s robust dataset and supplemented with Public Insight Data. The report includes detailed graphs and data points, offering a clear view of how different industries are managing tight labor markets and legislative changes for frontline roles. It’s important to note that our data does not reflect all positions equally; some job posts may represent a need for one hire, while others might represent a need for 1,000.

Index numbers are based on January 2022, a point of relative stability in a post-pandemic world for frontline workers.

This set of indices is an invaluable resource for HR professionals, recruiters, business leaders, and investors seeking to understand and navigate the complex landscape of frontline and essential workforces. It provides actionable insights that can help benchmark past and current performance, as well as forecast near-term industry trends and outlook.

View the latest FWI Report here →

View the August 2024 FWI Report here →

View the July 2024 FWI Report here →

View the April 2024 FWI Report here →