Talroo's Frontline Worker Index

April 2024 Summary: Posted Frontline Worker Wages Hit a 2-Year High

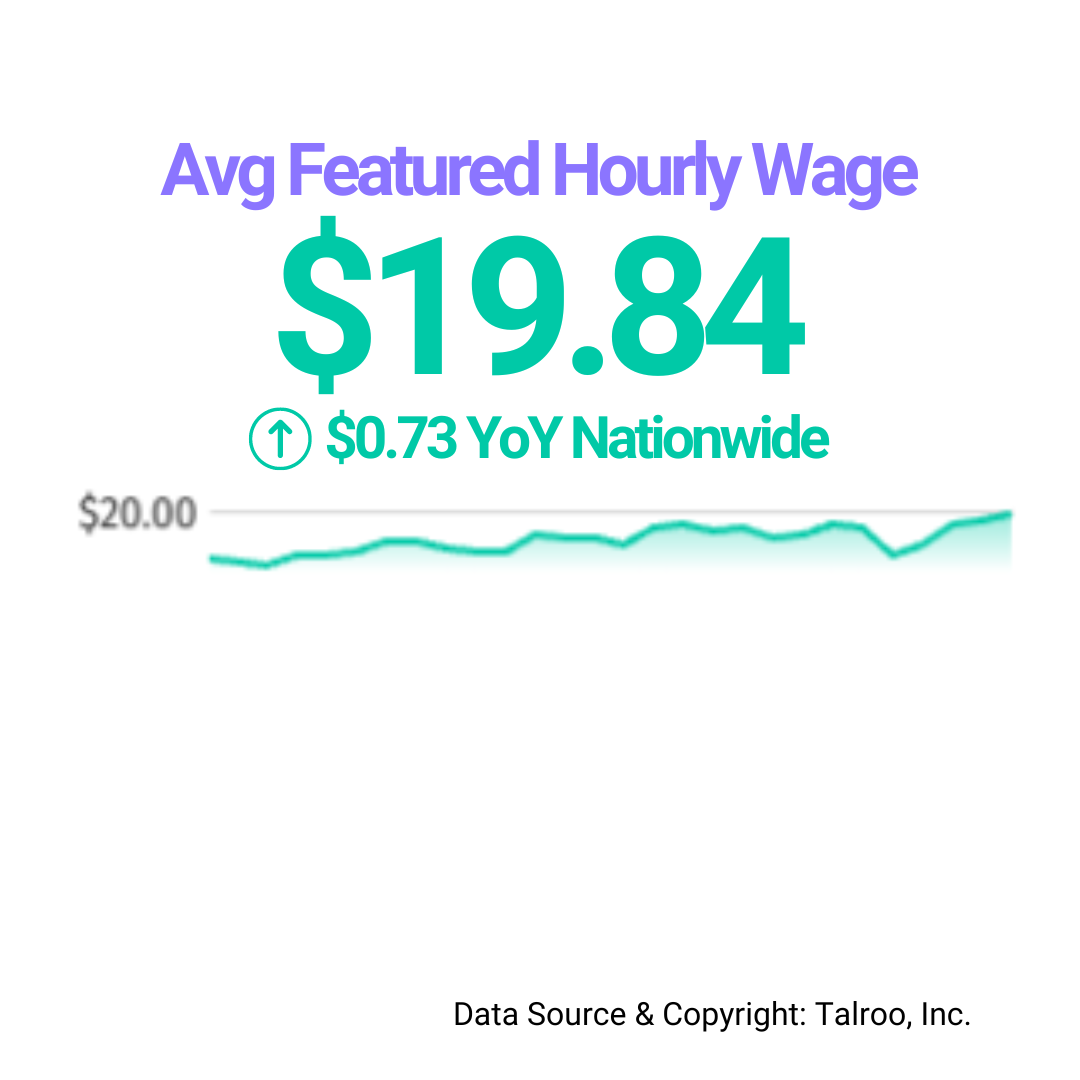

Average Hourly Wage Increase: Driven by pay transparency laws and a higher demand for experienced workers, the average posted hourly wage for frontline roles reached $19.84 nationwide, marking a significant rise.

Experience and Guaranteed Hours: Employers are increasingly requiring more experience and full-time positions, with indices for these requirements reaching a 2-year high above 100.

Legislative Impacts: Legislative changes, such as California’s fast food wage increase (AB 1228), are contributing to volatility in wages and education requirements as employers adjust to the new minimum standards.

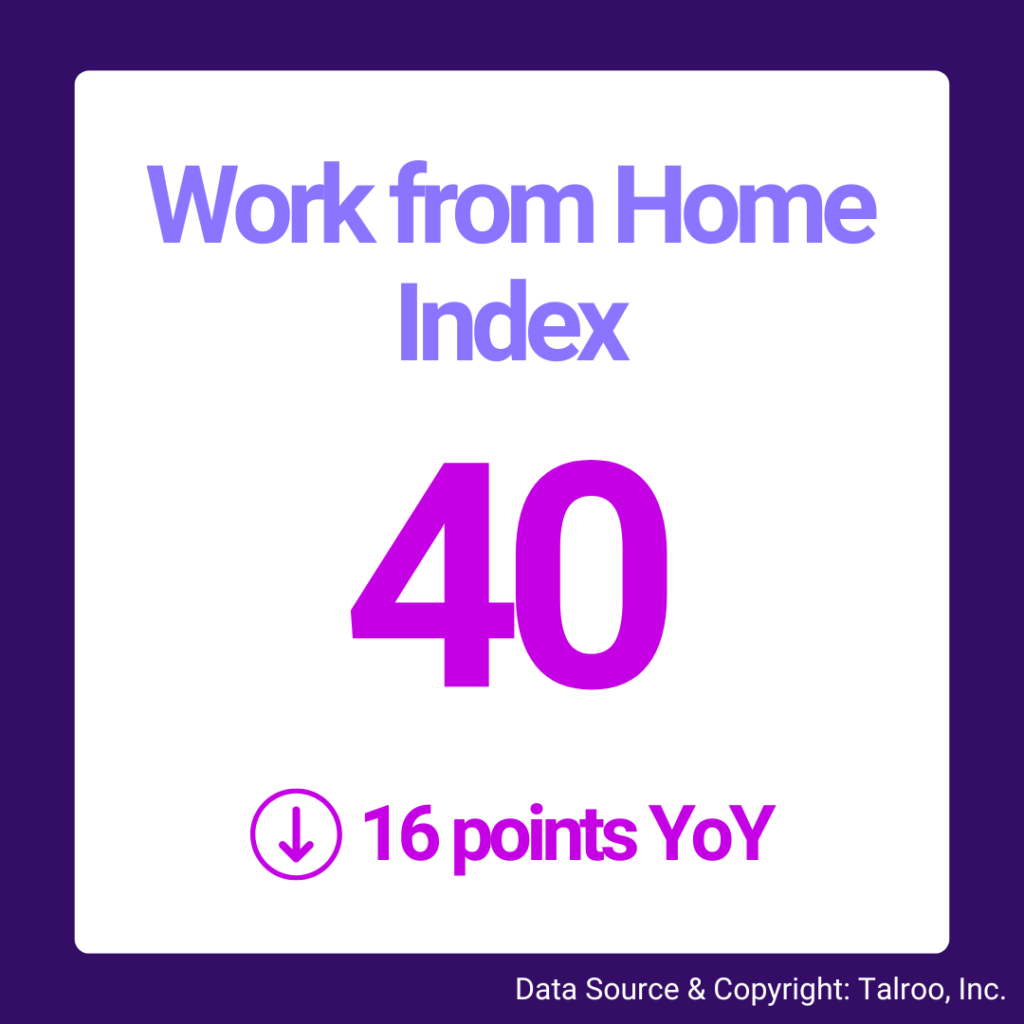

Remote Work: Following the Return-to-Work trend we’ve been seeing, Remote Work openings are down 16 points year over year and emphasis on in-person interactions for frontline employees.

The Frontline Worker Index Data & Findings

The Frontline Worker Index (FWI) provides data insight into supply and demand, job titles, wages and pay, work schedules, education and experience requirements, and the most valued benefits for these crucial roles. Understanding these metrics will help HR professionals and recruiters develop more effective strategies for attracting, hiring, and retaining top talent in an increasingly competitive job market.

Please note that the data shown in these graphs update regularly, so while this report was created with April 2024 data, the numbers shown in the interactive graphs may be different. However, you can still explore the data from that time period by updating the date range where applicable.

Supply & Demand

The FWI provides insight into job seeker supply and employer demand by contrasting newly created resumes and newly created job posts.

This graph can show the different industries that are trending towards a tighter labor market, or those that might have a more difficult time hiring, and industries that are seeing an abundance of available workers.

For example, if the Healthcare – Allied Health industry is selected from the dropdown, you’ll see the following insights.

The Allied Health industry, which includes EMTs, nurses, pharmacists, and other crucial medical support staff, continues to experience a tight labor market, as demonstrated by these trends:

- There was a massive increase in new job posts (indicating demand) in April 2023, followed by another significant rise at the start of 2024. As of April 2024, the Posting Index reached 836, showcasing continued high demand for healthcare professionals.

- The number of job seekers (supply) has increased steadily over this period, rising from 100 to 560. Despite this growth, the supply is still outpaced by the demand reflected in the Posting Index.

These indices suggest that while there has been some recovery, the number hasn’t fully rebounded from the steep dip observed from March 2023 to April 2023. The ongoing imbalance between job postings and available workers underscores the persistent challenges in staffing the Allied Health sector.

HR professionals and recruiters can take the following actions with this information:

- Offer competitive salaries and benefits, including student loan repayment, sign-on bonuses, and flexible schedules.

- Partner with schools, attend job fairs, use social media, and implement referral programs.

- Provide training, certification programs, and clear career advancement paths.

Job Titles

Continuing the conversation about supply and demand from the graph above, here we can see the demand of frontline job seekers who use Talroo-associated job boards and search engines, or the things they are searching for while looking for jobs, and the supply, or the job posts provided by employers using the Talroo landscape to advertise their positions.

Supply: Job Seeker Activity

Demand: Employer Job Posts

Most of the top job searches, 63%, pertain to how frontline job seekers want to work more than what they want to do. Right off the bat there’s a correlation: the top job posts all contain snippets from the top job searches and target those wants and needs from job seekers. This alignment demonstrates that understanding job seekers’ priorities, such as work-life balance, remote work options, and immediate start dates, can significantly boost the attractiveness of job postings.

Alternatively, Work from Home is by far the top query from job seekers, but that term is much less significant in terms of Employer Demand. This falls in line with another insight that will be explored in more detail in the Schedules & Hours section.

Companies that effectively address the desires of frontline and essential workers in their job descriptions are more likely to attract qualified candidates who are a good fit for their workplace culture and values.

Wages & Pay

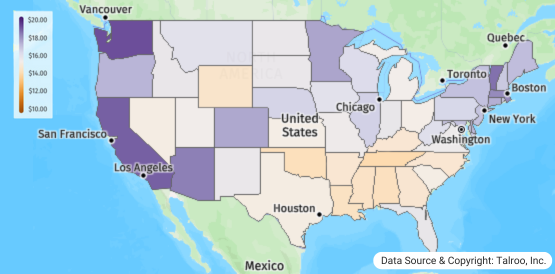

This dataset shows the average wage and sign-on bonus, when listed, for all jobs listed on the Talroo Ad Platform. Due to salary transparency laws that have been implemented in various states nationwide, there are some states that are more heavily represented in the map and final numbers than others. For instance, states like California and New York, which have stringent salary transparency requirements, contribute more data points, potentially skewing the overall averages higher. Conversely, states with less stringent or no transparency laws may have fewer listings, resulting in less representation in the dataset.

HR professionals and recruiters can leverage this dataset to make informed decisions and enhance their hiring strategies. Here are three key actions they can take:

- Use the dataset to compare average wages, the percentage of jobs offering sign-on bonuses, and the average sign-on bonus value in their industry and region, ensuring their offers are competitive and attractive to potential candidates.

- Analyze the data to identify emerging compensation trends, helping to adjust salary structures proactively to stay ahead in the job market.

- Implement or improve salary transparency in job listings to attract a broader pool of candidates, as transparency is increasingly valued by job seekers.

Schedules, Hours, & Remote Work

This dataset shows the indexed number of Work from Home, Part-Time, and Full-Time positions listed by clients using the Talroo Ad Platform. While it doesn’t necessarily skew the numbers, it’s important to keep in mind that some positions are listed as either part-time or full-time, depending on availability or store needs.

Key Talroo Data

What we’re seeing in the Remote Work or Work from Home index falls in line with the “Return to the Office” trend.

- Work from Home positions are down 16 points year over year for frontline and essential workers.

- This shift indicates a growing emphasis on in-person roles as businesses prioritize on-site operations and face-to-face interactions.

Knowing the Work from Home Index, Part-Time Index, and Full-Time Index for their industry, the position they’re hiring for, or their state is crucial for HR professionals and recruiters. Here are three key reasons why:

- Use these indices to anticipate workforce needs and plan accordingly.

- Adjust job postings and recruitment tactics to align with current market dynamics.

- Ensure competitive compensation and benefits packages by comparing with industry standards.

Education & Experience

This index comes from Talroo clients who list education or experience as not required for their specific job posts. For example, if a cashier position does not require a high school education or prior experience, that position would fall into this index.

Key Talroo Data

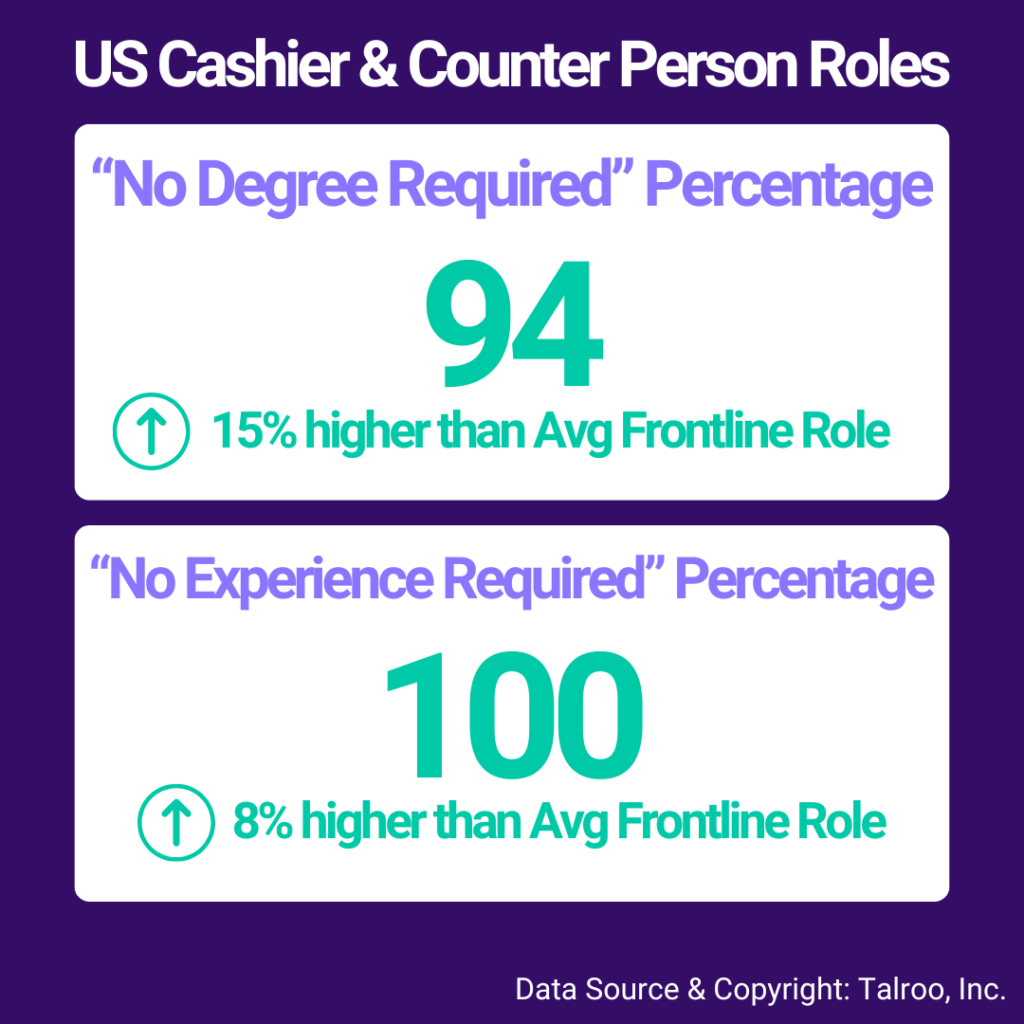

Talroo data shows education and experience requirements remaining almost flat since January 2022, with each index decreasing by 9 and 4 points, respectively. However, a more indicative position for the frontline and essential worker landscape is the Cashier/Counter Person role.

Let’s look at the data:

- "No Degree Required" is 94%, 15% higher than the national average.

- "No Experience Required" is 100%, 8% higher than the national average.

Both indexes have remained relatively unchanged since January 2022, with “No Degree Required” up one point and “No Experience Required” staying the same.

This trend might be happening for several reasons:

- Frontline and essential roles often experience high turnover, prompting employers to lower entry barriers to quickly fill positions.

- The ongoing demand for essential services requires rapid hiring processes, leading employers to prioritize availability over formal qualifications.

- Companies may offer on-the-job training and upskilling programs, reducing the need for prior education or experience requirements.

Dive into the data with the graphs below to see what requirements look like in specific states or industries:

HR professionals and recruiters can stay competitive with these strategies:

- Simplify application procedures and reduce time-to-hire to quickly fill positions.

- Highlight comprehensive training programs to attract candidates eager to learn and grow.

- Use diverse recruitment channels, including online job boards, social media, and employee referral programs, to reach a wide audience.

Benefits

Frontline and essential workers are the backbone of many industries, performing critical roles that keep businesses and services running smoothly. Understanding the benefits most important to them is crucial for effective recruitment and retention.

Key benefits for frontline workers include competitive wages, comprehensive health insurance, PTO, flexible work arrangements, and professional development opportunities. These benefits ensure fair compensation, security, work-life balance, job satisfaction, and career growth.

HR professionals and recruiters can leverage this understanding of essential worker benefits to improve their hiring and retention strategies. Here are three key actions they can take:

- Offer competitive wages and health benefits to attract and retain top frontline talent.

- Implement flexible work arrangements to enhance job satisfaction and reduce stress.

- Provide training and career advancement opportunities to show commitment to employee growth.

By focusing on these areas, HR professionals and recruiters can create a more appealing work environment for frontline and essential workers, leading to higher job satisfaction and better retention rates.

Frontline Worker Trends: Legislative Impacts

This section explores two key trends in the frontline worker market from the FWI data. Firstly, it examines the impact of California’s wage increase law on the fast-food industry, highlighting how employers and employees adapt to the new wage landscape. Secondly, it addresses the rising demand for phlebotomists, driven by demographic changes and healthcare needs, and the relative lack of legislation compared to other healthcare roles. Let’s dive in.

California’s Fast Food Worker Wage Increase: How It Impacts Employers

California’s wage increase law has significantly changed the hiring landscape for the fast-food industry. This section explores its initial and broader impacts on job postings, wage trends, and industry practices, offering insights into how employers and workers are adapting.

AB 1228, effective April 1, 2024, applies only to fast food chains with at least 60 nationwide locations, limited table service, and immediate food service.

Talroo’s data groups all food services, so while it may not be exclusive to fast food, initial impacts are still visible.

Initial Impacts of AB 1228

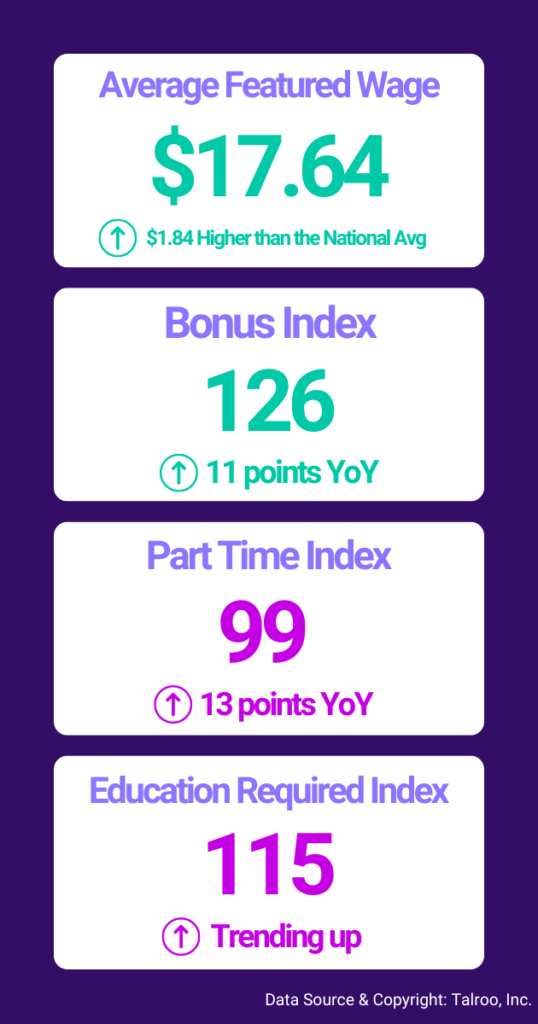

- Part-time job postings have increased by 13 points. This likely reflects employers' efforts to manage labor costs by hiring more part-time workers instead of full-time employees.

- Advertised wages in California's food services sector are $1.84 higher than the national average. This indicates that businesses are raising wages to attract talent in a competitive market as well as stay compliant with this law.

- The wage increase is expected to influence the entire food services industry, pushing wages higher. To remain competitive, businesses will need to advertise attractive wages.

Broader Context and Additional Insights

- Higher wages have improved some workers' quality of life but led to reduced hours for others.

- Increased labor costs may accelerate automation to reduce dependency on human workers.

- The California Fast Food Workers Union (CAFFWU) represents a shift toward better worker rights and future industry standards.

- Early indications suggest higher wages could improve worker retention and job growth, despite fears of job cuts and price increases.

The wage increase for fast food workers in California has shifted hiring practices and wage trends. Employers are raising part-time job postings and wages to stay competitive. These changes highlight the need for competitive wages to attract and retain talent in a dynamic market.

Key Talroo Data

Nationwide Map of Average Wages for Food Services Positions

Proactive Shifts in Phlebotomist Requirements & Wages

The demand for phlebotomists is rapidly increasing due to several key factors, backed up by Talroo’s proprietary data. Here’s why this demand is rising and some potential solutions to proactively address it.

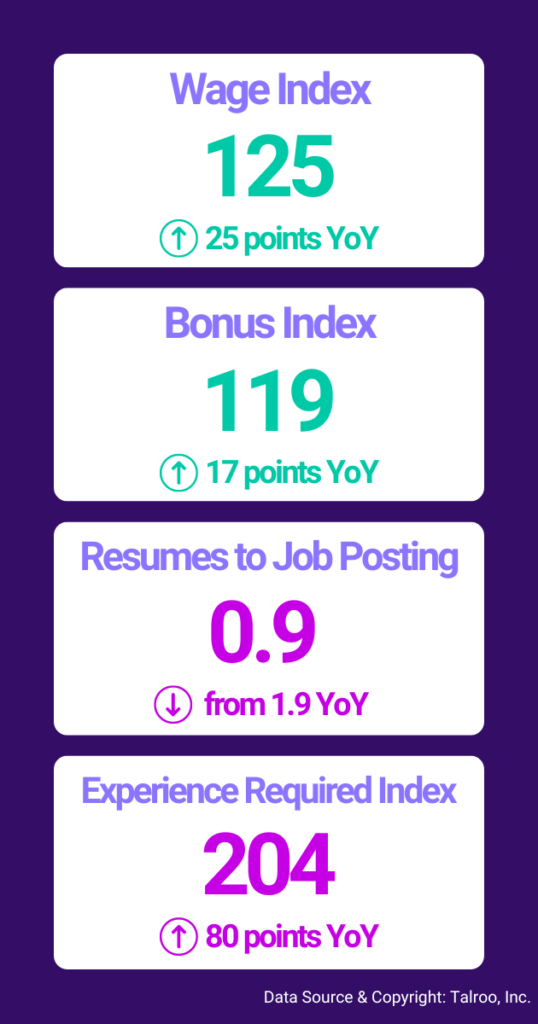

Key Talroo Data

Key Trends

- The Wage Index has increased by 25 points from last year, indicating a significant rise in overall wage levels to attract and retain employees.

- Experience requirements are up by 80 points, reflecting a growing emphasis on hiring more experienced candidates in the job market.

- Licensing requirements vary, with only four states requiring licenses while others require basic training or certifications, highlighting the differing regulatory landscapes across the country.

Rising Demand Factors

- Elderly Population Growth: More medical care and diagnostic tests are needed.

- Chronic Diseases: Increased cases of diabetes and heart disease require regular blood tests.

- New Technologies: Advanced medical treatments need precise blood samples for research and testing.

Employers are proactively increasing experience requirements and wages to stay ahead of potential new regulations, reflecting a strategic move to hire more skilled phlebotomists without relying on on-the-job training.

Solutions for HR and Recruiting

- Partner with educational institutions to ensure a steady supply of trained phlebotomists.

- Invest in ongoing training and certification programs.

- Offer attractive compensation and career advancement opportunities.

Talroo data indicates a big change in the phlebotomist hiring landscape. Employers can prepare for future regulations and competition by increasing wages and experience requirements, ensuring they attract and retain top talent.

Frontline Worker Index Explorer

If you want to explore Talroo’s data and search findings to help you recruit and hire, you can below! Use the Industry Explorer here to see nationwide trends or select specific states to narrow down your exploration. Additionally, you can select industries or even specific job titles to narrow your search further. Happy searching!

The Frontline Worker Index Report: Methodology

Talroo processes an average of 26 million job posts every month, with over 187 million datapoints adding to this index directly. This extensive dataset is sourced directly from Talroo, reflecting a broad spectrum of industries and geographic locations. Some job posts are comprehensive while others are less detailed; our goal is to encourage companies to be more transparent and intentional with their job posts to improve data quality and utility.

Powered by Talroo’s robust dataset and supplemented with Public Insight Data, the FWI reflects information from a wide range of sectors. The report includes detailed graphs and data points, offering a clear view of how different industries are managing tight labor markets and legislative changes for frontline roles. Index numbers are based on January 2022, a point of relative stability in a post-pandemic world for frontline workers.

This set of indices is an invaluable resource for HR professionals, recruiters, business leaders, and investors seeking to understand and navigate the complex landscape of frontline and essential workforces. It provides actionable insights that can help benchmark past and current performance, as well as forecast near-term industry trends and outlook.

View the latest FWI Report here →

View the August 2024 FWI Report here →

View the July 2024 FWI Report here →

View the June 2024 FWI Report here →