Talroo's Frontline Worker Index

Frontline Worker Index

July 2024 Summary: Trends in Resumes, Job Postings, and Entry-Level Indices

The frontline job market is shifting as employers demand higher skills and qualifications, reshaping hiring practices.

• Job postings are rising, while resume submissions are declining, but the overall supply of workers is still up YoY. This could indicate a softening of the market as opposed to a full-on tightening.

• Wages have increased steadily, reflecting compensation for higher qualifications, yet highlighting the challenge of attracting talent in a softening market.

• “No degree required” and entry-level job indexes, which indicate the number of entry-level jobs not requiring a degree or experience, are trending downward. This points to a trend towards pickier employers, widening the gap between available workers and job requirements.

The Frontline Worker Index Data & Findings

The Frontline Worker Index (FWI) offers data insights on supply and demand, job titles, wages, work schedules, education and experience requirements, and the most valued benefits for frontline roles. Understanding these metrics helps HR professionals and recruiters create better strategies for attracting, hiring, and retaining top talent in a competitive job market.

Supply & Demand

The FWI compares new resumes and new job posts to show the balance between job seeker supply and employer demand.

April’s trend of rising resumes and fewer job postings has shifted to the opposite scenario in June and July 2024—where resumes have declined and job postings have increased—suggests a softening labor market. What does this mean?

- There is a growing demand for candidates, as job postings continue to rise while the number of resumes declines.

- The labor market might be experiencing a softening, with fewer job seekers actively applying, possibly due to economic factors or a stronger job market where individuals feel secure in their current positions.

- Employers are increasingly seeking to fill positions, but may be facing challenges in finding qualified candidates, leading to heightened competition for talent.

Overall Implications:

- Companies may need to enhance their recruitment efforts by offering more competitive wages, better benefits, or more attractive work conditions to draw in the limited pool of job seekers.

- The labor market dynamics suggest that job seekers could begin to gain more bargaining power, allowing them to be more selective about the roles they pursue.

- Employers may need to reassess their hiring strategies, including improving job descriptions, offering incentives like sign-on bonuses, or boosting their overall employer brand to stand out in a competitive market.

These contrasting trends underscore the fluid nature of the labor market, emphasizing the importance for both employers and job seekers to remain flexible and responsive to evolving conditions.

Despite this being the general trend, there are some industries that are resilient, according to Talroo data. Hospitality and Food Services don’t seem to be seeing the same indexing, and thus are less likely to be impacted by a resume shortage.

Job Titles

Continuing the discussion on supply and demand from the graph above, this section shows the demand from frontline job seekers using Talroo-associated job boards and search engines, and the supply, which consists of job posts from employers advertising through Talroo.

Supply: Job Seeker Activity

Demand: Employer Job Posts

Half of the top job searches on Talroo-associated job boards and search engines relate more to how frontline and essential workers want to work than what they want to do. This falls in line with what we’ve seen through all our index reports, although the percentage has dropped slightly. And much like April and June’s findings, there’s a correlation between the top searches and the top job titles: the majority include information that pertains to not just what the job will be, but how the work will be.

And despite the fact that Work from Home remains the top query in Talroo-associated job boards and search engines, that index has continued to drop, showing it is less of a priority for employers, which will be discussed more in the Schedules, Hours, & Remote Work section.

Companies that clearly outline what frontline and essential workers want in job descriptions are more likely to attract qualified candidates who fit well with their workplace culture and values.

Wages & Pay

This dataset shows the average wage and sign-on bonus for all jobs listed on the Talroo Ad Platform. Because of salary transparency laws in various states, some states are more represented in the map and final numbers than others.

For example, states like California and New York, which have strict salary transparency laws, provide more detailed data, potentially pushing overall averages higher. On the other hand, states with fewer or no transparency requirements might have fewer job listings, leading to less data representation in the overall dataset.

Additionally, the sign-on bonus index only includes jobs that specifically mention a starting bonus. You can find the percentage of jobs offering a bonus in Talroo’s ecosystem under the “Offers Bonus” section.

When reviewing this table, keep in mind that wages are reflective of experience and other requirements as well, and the increase in wages corresponds with an increase in experience as well as less remote work.

HR professionals and recruiters can use this dataset to improve their hiring strategies. Here are three actions they can take:

- Compare average wages, the percentage of jobs offering sign-on bonuses, and the average bonus amount in their industry and region to ensure their compensation packages are competitive.

- Analyze the data to spot emerging compensation trends and adjust salary structures to stay competitive in the job market.

- Increase salary transparency in job postings to attract more candidates, as job seekers are placing greater value on this openness.

Schedules, Hours, & Remote Work

This dataset shows the indexed Work from Home, Part-Time, and Full-Time positions listed by clients on the Talroo Ad Platform. It’s important to note that some positions may be listed as part-time or full-time based on availability or store needs, but this doesn’t necessarily affect the overall numbers.

Key Talroo Data

The trends in the Remote Work or Work from Home index match the “Return to the Office” movement.

- Work from Home positions have dropped 50 points year over year and 2 points month over month for frontline and essential workers.

- The trends in the Remote Work or Work from Home index match the “Return to the Office” movement.

This shift shows a growing focus on in-person roles as businesses emphasize on-site operations and face-to-face interactions.

HR professionals and recruiters should be aware of the Work from Home Index, Part-Time Index, and Full-Time Index specific to their industry, the roles they’re hiring for, and their state. Here are three important reasons why:

- Use these indices to anticipate workforce needs and plan staffing strategies effectively.

- Adapt job postings and recruitment approaches to stay aligned with current market trends.

- Compare compensation and benefits packages against industry standards to remain competitive.

Education & Experience

This index includes Talroo clients who list jobs that don’t require education or experience. For example, a cashier position that doesn’t need a high school diploma or prior experience would be part of this index.

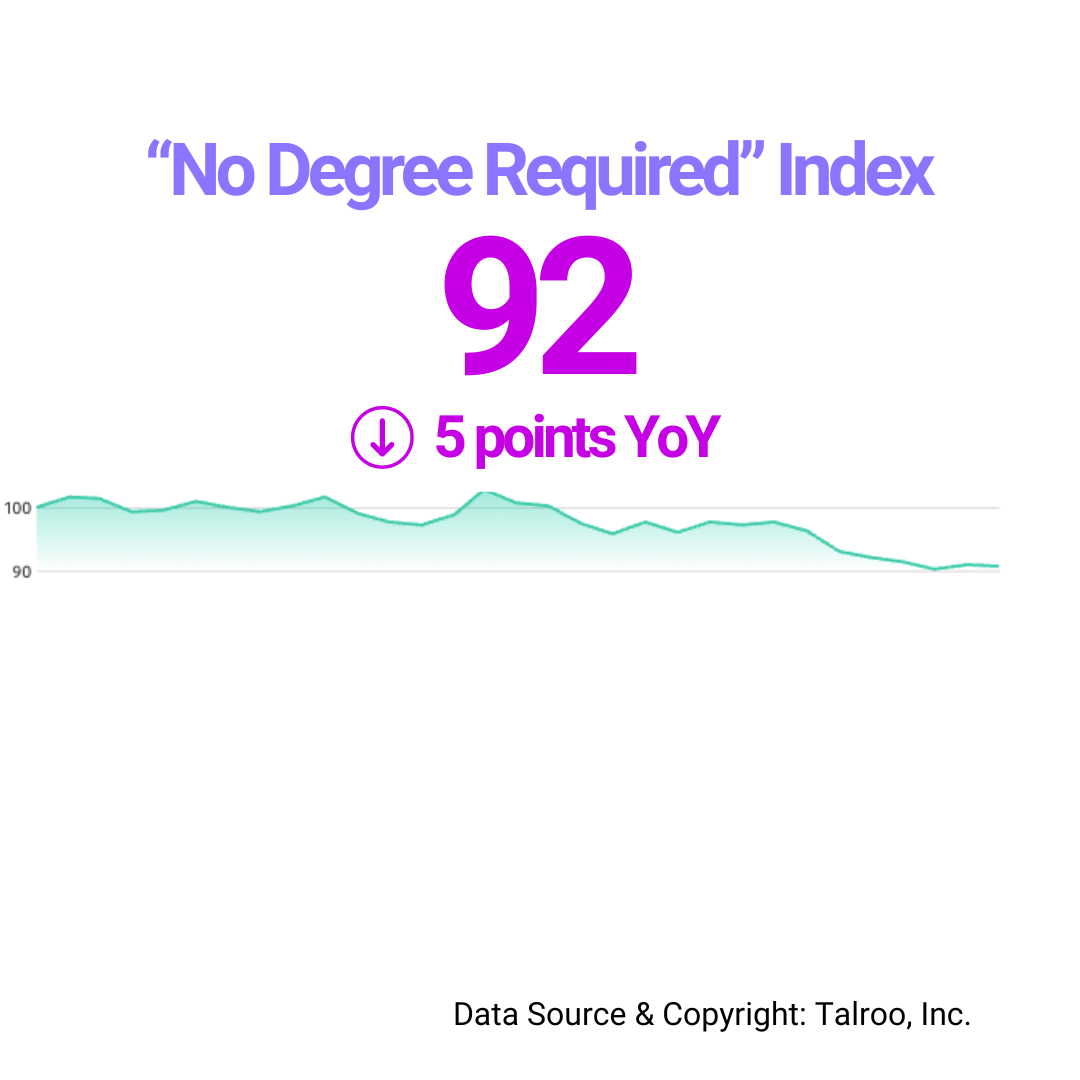

Both indexes have continued to decline since March 2023, with the “No Degree Required” index dropping by five points and the “No Experience Required” index dropping by two this month.

This may be influenced by several factors:

- The decline in these indexes suggests that employers are increasingly seeking candidates with more formal qualifications and experience, likely in response to a tightening labor market where they can afford to be more selective.

- Employers may be emphasizing degrees and relevant experience more than before, possibly due to the complexity of roles or the availability of candidates with these qualifications, leading to a reduction in jobs that do not require a degree or prior experience.

- As competition for skilled workers intensifies, companies might be raising their standards to attract higher-caliber candidates, making prior education and experience more critical in the hiring process.

Explore the graphs below to see how these requirements vary across different states or industries:

Trends in Education & Experience Over Time

“No Degree Required” Index

“No Experience Required” Index

HR professionals and recruiters can stay ahead with these strategies:

- Lower education and experience requirements to attract a broader candidate pool and expedite the hiring process.

- Invest in on-the-job training and upskilling programs to ensure that new hires can quickly become effective in their roles.

- Highlight the minimal education or experience requirements in job postings to appeal to a wider audience of potential applicants.

Benefits

Frontline and essential workers play a critical role in keeping many industries and services running smoothly. Understanding the key benefits they value is essential for successful recruitment and retention. The following image shows the average sign-on bonus for positions in the Talroo ecosystem, as well as the percentage of positions that offer a sign-on bonus.

As you can see, the average sign-on bonus has dropped almost 18% since July 2023, and the number of jobs in Talroo’s ecosystem that are offering bonuses has dropped by 0.5%. What this means for the industry:

- The drop in average sign-on bonuses suggests employers may be reducing incentives due to budget constraints or questioning their effectiveness.

- A slight decline in jobs offering bonuses could indicate market saturation, diminishing their competitive advantage.

- Employers might be prioritizing long-term benefits like higher wages or job security over short-term incentives like sign-on bonuses.

- The reduction in sign-on bonuses could slow recruitment, requiring alternative strategies to attract candidates.

- This trend may reflect a broader industry shift, prompting employers to re-evaluate the role of financial incentives in recruitment.

Frontline Worker Trends: Labor Market Supply and Demand Mismatch

Let’s delve into the current trends in the labor market, focusing on the growing mismatch between job openings and resume postings. Using insights from recent reports and data from the Bureau of Labor Statistics, we provide a detailed analysis of how these trends are influencing various industries and the broader labor market.

Rise in Job Postings and Decline in Resumes

- Surge in Job Postings: Job openings remain high across most industries, with employers struggling to fill roles, especially in sectors like healthcare and construction, which saw substantial job additions in July 2024.

- Decline in Resume Submissions: Despite the increase in job postings, resume submissions have continued to decline, reflecting a broader hesitancy among job seekers to change positions or re-enter the workforce. This hesitancy is now giving way to a new trend, as workers begin to reconsider their positions, signaling the onset of the "Great Resignation 2.0."

Factors Contributing to the Mismatch

- The Shift Towards the "Great Resignation 2.0": After a period of stability where many workers stayed in their roles despite dissatisfaction ("The Big Stay"), recent surveys indicate a significant shift. Nearly 28% of workers are planning to quit by the end of 2024, marking a potential resurgence of mass resignations. This shift is particularly notable among Gen Zers and young millennials, who are increasingly seeking better pay, benefits, and work environments.

- Unemployment Rate and Workforce Participation: The unemployment rate rose to 4.3% in July 2024, with 7.2 million unemployed. However, the labor force participation rate remains low, indicating a significant portion of the population is not actively seeking work despite available opportunities. This continued disengagement, coupled with the impending wave of resignations, exacerbates the mismatch between job supply and candidate demand.

- More Stringent Job Requirements: Employers' increasing demand for higher qualifications and experience levels is another contributing factor. This trend may be deterring frontline and essential workers from applying to positions they would have previously qualified for, further deepening the gap between job openings and available candidates.

Implications for Employers and Job Seekers

The ongoing mismatch between job supply and candidate demand presents challenges for both employers and job seekers. Employers may face heightened difficulties in filling roles, particularly as more workers consider leaving their current positions. On the other hand, job seekers, particularly those in frontline and essential roles, may find themselves in a stronger negotiating position as demand for labor increases and supply remains tight.

Recommendations for Navigating the Labor Market

- For Employers: Consider enhancing job postings, offering competitive wages, and highlighting benefits to attract a broader pool of candidates. Addressing the specific concerns of workers—such as pay, benefits, and work conditions—will be crucial in retaining current employees and attracting new ones amid the potential resignation wave.

- For Job Seekers: Focus on upskilling and training, particularly in sectors with high demand but low resume submissions. The upcoming wave of resignations could present new opportunities for those looking to advance their careers or negotiate better terms in their current roles.

The current labor market trends emphasize the need for adaptability and proactive strategies from both employers and job seekers to navigate the evolving landscape effectively. As the “Great Resignation 2.0” looms, staying informed and prepared will be key to success in 2024.

External Sources: Bureau of Labor Statistics, Bloomberg, Resume Builder

Frontline Worker Index Explorer

To explore Talroo’s data and search findings for recruiting and hiring, use the Industry Explorer below. You can view nationwide trends or focus on specific states. Additionally, you can narrow your search by selecting industries or specific job titles. Happy searching!

The Frontline Worker Index Report: Methodology

Talroo processes an average of 26 million job posts every month, with over 187 million data points adding to this index directly. This extensive dataset is sourced first-party directly from Talroo, reflecting a broad spectrum of industries and geographic locations. Some job posts are comprehensive while others are less detailed; our goal is to encourage companies to be more transparent and intentional with their job posts to improve data quality and utility.

The FWI reflects information from a wide range of sectors, powered by Talroo’s robust dataset and supplemented with Public Insight Data. The report includes detailed graphs and data points, offering a clear view of how different industries are managing tight labor markets and legislative changes for frontline roles. It’s important to note that our data does not reflect all positions equally; some job posts may represent a need for one hire, while others might represent a need for 1,000.

Index numbers are based on January 2022, a point of relative stability in a post-pandemic world for frontline workers.

This set of indices is an invaluable resource for HR professionals, recruiters, business leaders, and investors seeking to understand and navigate the complex landscape of frontline and essential workforces. It provides actionable insights that can help benchmark past and current performance, as well as forecast near-term industry trends and outlook.

View the latest FWI Report here →

View the June 2024 FWI Report here →

View the April 2024 FWI Report here →

View the August 2024 FWI Report here →